Top Guidelines Of Lamina Loans

Table of ContentsLamina Loans - QuestionsMore About Lamina LoansNot known Factual Statements About Lamina Loans The Lamina Loans DiariesSome Of Lamina Loans

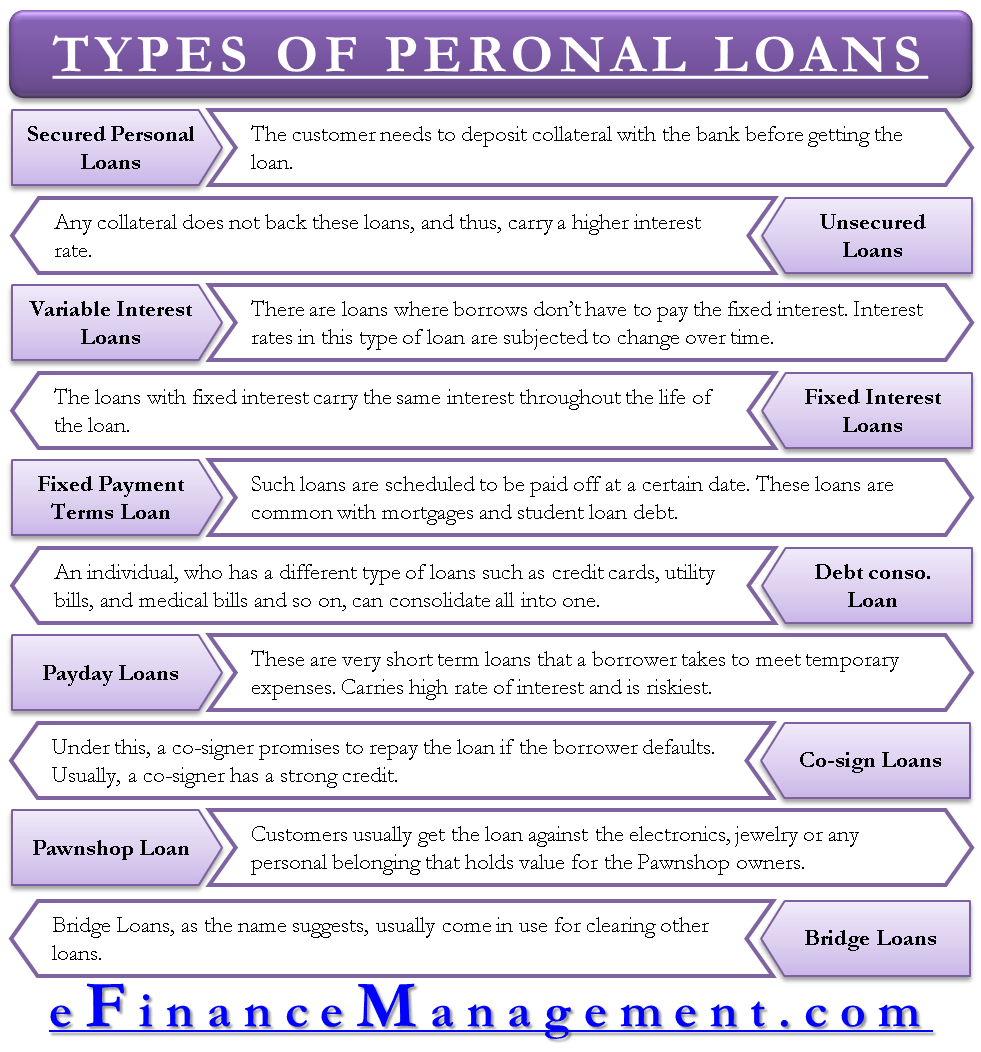

Different kinds of fundings can give access to possessions, job growth and other chances. In conclusion, there are 9 sorts of car loans you must recognize, as well as they cover various kinds of excellent and also uncollectable bill. Whether you're looking for funds to go to university or acquire your initial residence, here's what you need to find out about each sort of funding.Features of each car loan type like loan size and interest prices can vary. (APRs) and also fixed minimum month-to-month repayments.

, you won't require collateral to apply for one just an excellent credit rating and constant as well as solid debt background. Individual lendings can normally be made use of for just about any type of function.

Things about Lamina Loans

A debt combination loan might not be best for those with negative credit score, as it may not be worth it to seek it if you can't obtain a reduced APR. To learn if this kind of debt is a great fit for you, calculate your potential financial savings making use of a financial obligation consolidation calculator.

There are many types of mortgage conventional, FHA and VA, among others all of which depend on elements like your background as well as revenue. The majority of home mortgages finances are 15, 20 or three decades long, though you might additionally find longer or much shorter terms (Lamina Loans). They can come with fixed or variable rates of interest.

These kinds of fundings are normally unsafe and can cover costs varying from space and also board, books as well as tuition. They can come with repaired or variable rates of interest. This type of financial debt can be divided right into two teams: private and government student fundings. As the names imply, the former are stemmed by private firms, while the latter is moneyed by the federal government.

Bank loan are a kind of credit that enable business owners to accessibility capital to expand their expanding organizations. This can imply utilizing lending funds for devices, buying supply or perhaps covering pay-roll. Some lending institutions even provide SBA financings backed by the Small company Administration (SBA); these can be as huge as $5 million.

4 Easy Facts About Lamina Loans Shown

Rather of getting a swelling amount of money or an asset upfront, the loan quantity is saved in a protected bank account that you can only gain access to when you pay off the financing.

With amounts typically up to $500, payday advance are taken into consideration an aggressive sort of borrowing due their overpriced rates of interest (as high as 400%) (Lamina Loans). Integrated with brief settlement regards to simply two to 4 weeks, payday car loans can quickly trap borrowers in a cycle of financial obligation, as they might have to take even more fundings to repay their original payday financial obligation.

Your credit rating the most typical of which are FICO Score as well as Vantage, Score will certainly establish the tone of moved here what lending institutions you may certify with and what APRs you might obtain. If you pick to take out a loan that uses an adaptable financing objective, you'll still need to reveal to your loan provider just how you intend to use the funds as some loan providers have limitations on just how finances can be utilized.

This is just how much it will cost you to take out a finance, including interest prices and costs. Exactly how much time you have to settle your finance has an effect on what APRs you're paying.

The Ultimate Guide To Lamina Loans

Exactly how much you're allowed browse around this web-site to obtain will certainly depend on factors like your income, exactly how you prepare to utilize the loan and your credit history., you may have a hard time getting a big lending amount.

Borrowed money can be utilized for several objectives, from funding a new organization to purchasing your fiance an engagement ring. Yet with every one of the various kinds of loans available, which is the bestand for which objective? Below are the most common kinds of lendings as well as exactly how they work.

Home-equity fundings have low rate of interest rates, yet the consumer's house serves as collateral. Cash money breakthroughs commonly have really high rate of interest rates plus transaction costs.

Lamina Loans Fundamentals Explained

Typically, an individual funding can be obtained for a couple of hundred to a few thousand bucks, with repayment durations of 2 to 5 years. Consumers require some type of income verification as well as evidence of properties worth at the very least as high as the quantity being borrowed. The application is commonly only a page or 2 in length, and also the approval or denial is usually issued within a few days.

21% in the initial quarter of 2023, according to the Federal Get. Passion prices can be even more than 3 times that quantity: Avant's APRs vary from 9. 95% to 35.

An individual loan is probably the most effective way to go for those who need to borrow a fairly small amount of money as well as are specific they can repay it within a number of years. A personal lending calculator can be a valuable tool for determining what kind official website of rates of interest is within your ways. If the consumer stops working to satisfy the relevant legal commitment with the third party, that celebration can demand settlement from the financial institution. The warranty is commonly a setup for a financial institution's small-business customers.